Relative Strength Index

I want to write a post about an indicator that I find quite useful.

Relative Strength Index (RSI).

What is it

Definition from Investopedia:

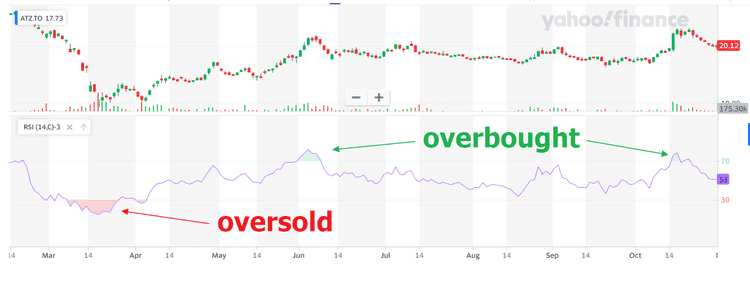

The relative strength index (RSI) is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset.

Basically, it’s something you can use to see if a stock has been over-bought or over-sold.

Why you should use it

You can use it to better understand the market(s) behind the stocks you are looking at. Understand what’s causing it to go up / down.

How to use it

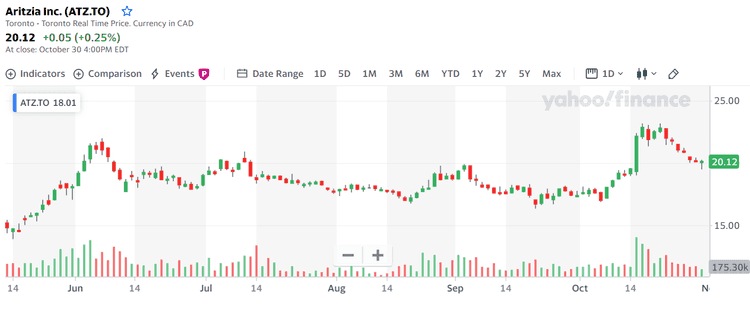

- Load up the graph of a stock. Here, I will use Aritzia Inc (ATZ.TO).

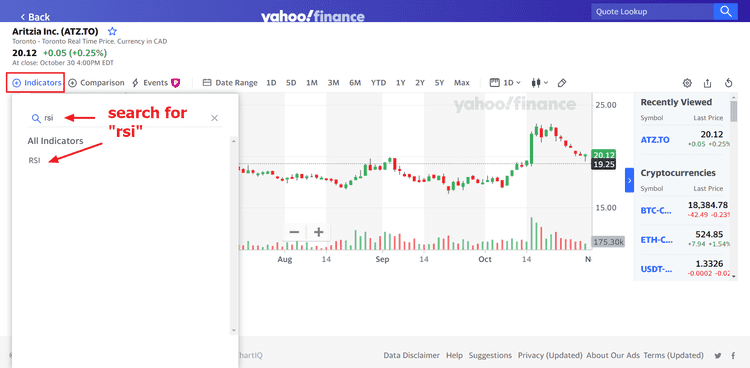

- Add an RSI Indicator

- Set up config

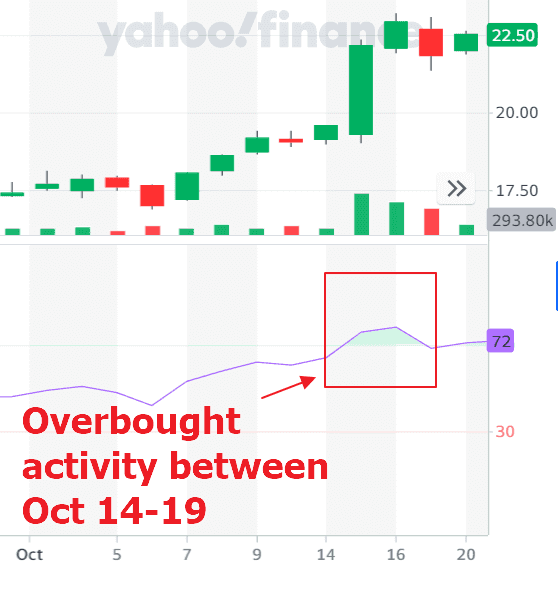

- Observe the graph

- Investigate overbought / oversold areas

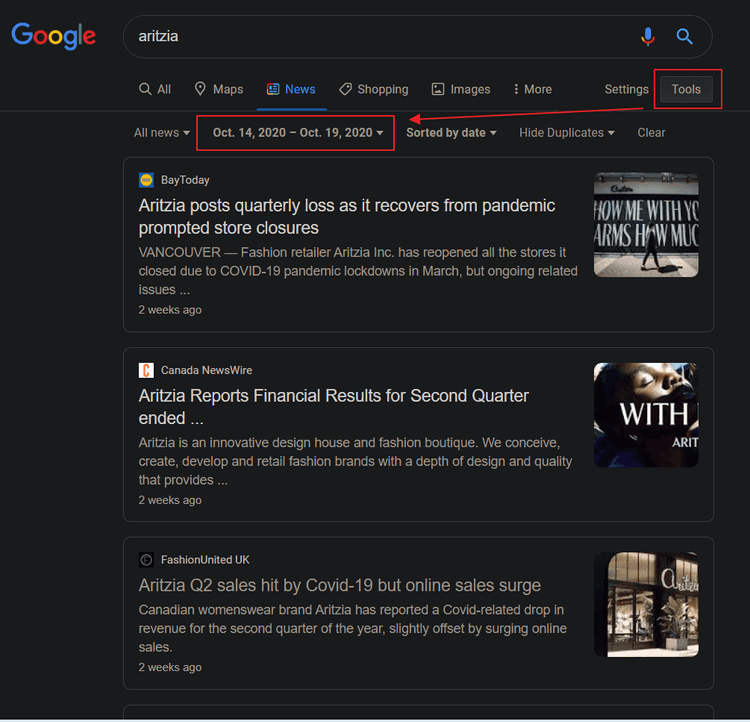

- Do your research and find out if it’s justifiable

Bloomberg Terminal Function

Shameless plug lol I work at Bloomberg and there is this one function on the Terminal that is related and super useful.

GPC <GO>

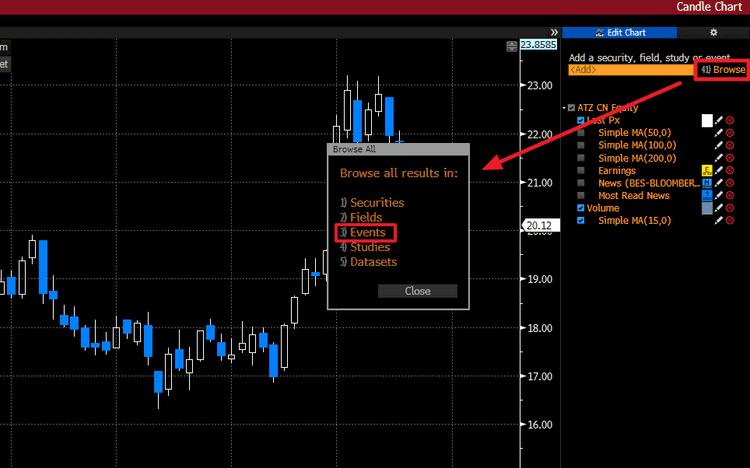

- Load up a graph using GPC <GO>

- Click on Browse and choose Events.

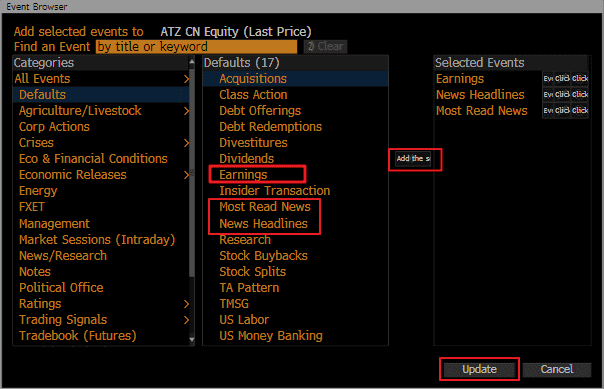

- Add whatever you want, but I like to add Earnings, Most Read News and News Headlines.

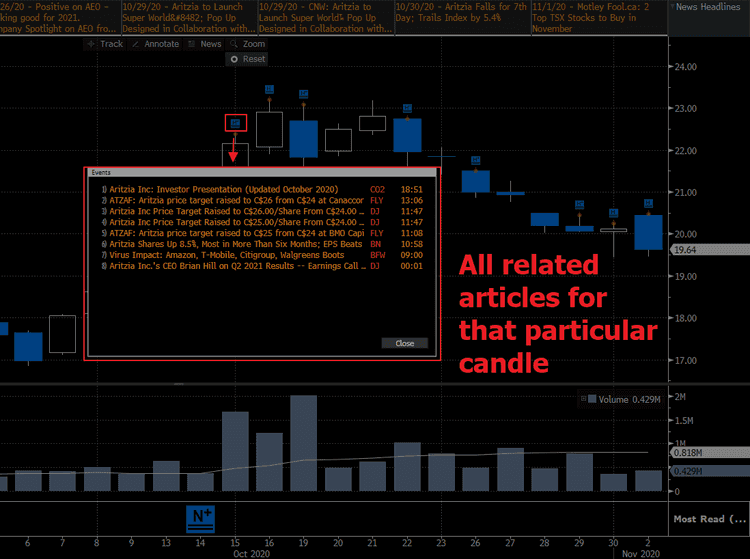

- Observe the graph

No, I wasn’t sponsored by Bloomberg or anything for this post. Just a cool tool I found on the Terminal during work and just wanted to share.

That’s all. Happy investing!