Is investing during a recession a good idea?

Fears of a recession is getting quite real these days. Trade wars, economic slowdowns, blah blah blah the world is going to shit.

Should you invest in these times? Is it a good idea? Or should you withdraw your investments to keep them safe from further depreciation?

Historically speaking, it has always been a good idea to hold / buy more during a recession.

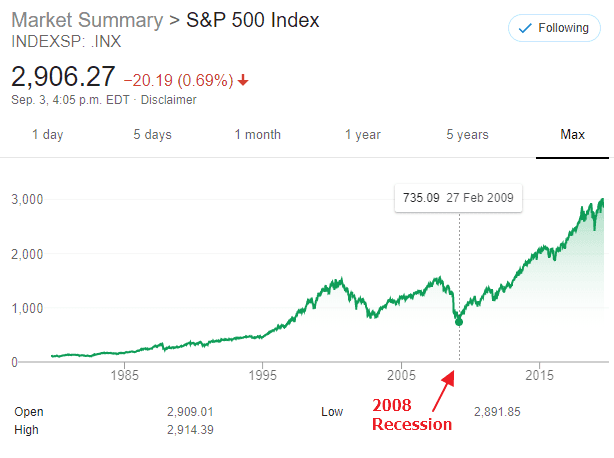

Take a look at the S&P 500 index here:

It dipped as low as $735.09 in Feb 2009, but take a look at what followed in the next 10 years. Would it have been better to sell or buy more at that point?

In the book Millionaire Teacher by Andrew Hallam, it gives a metaphor saying stocks are like dogs on a leash. An owner goes out for a walk with his dog. He puts his dog on a leash and proceeds to walk from his home to the park. On the way, his dog runs back and forth, left and right, and anywhere as long as the leash is long enough. Since the leash is bound to the owner however, the dog is destined to reach the park. While the owner is walking in a straightforward manner to the park, the dog may run forwards, backwards, etc. The point is, they will both reach the park.

We can use this analogy on companies and their stocks. While a company grows, its stock may emit jittery behavior. It may spike up for a week. It may drop down a month. But in the long run, as long as the company is successfully growing, the stocks will reflect it.

Then when you look at hundreds of companies, you look at it in the perspective of an “economy”. One company might fail and declare bankruptcy, and stocks turn into dust. But what if 99 other companies report a 10% annual growth? This is where diversified investments come in handy, but I’m digressing now.

Back to the point. Is it safe to invest during a recession? Depends on your age and whether or not you think the world is doomed.

If you are old, you should have prepared yourself for retirement by having a majority allocation of bonds than stocks. And you should be preparing to collect your investments, not put more in.

If you are young, ask yourself: is the economy never ever going to recover from this point? Is everything going to shit? If so, don’t invest.

The thing is, history has shown us, time and time again, that we have gotten through recessions onto better thriving economies. If you don’t believe me, go and google other index funds to see for yourself.

As for me, I’m young. I see recessions as a SALE for stocks. I see this recession as an opportunity to invest more for my future gains.

The only problem I have with this recession is that I can’t buy more.

That’s all for this week. Hope you learned something new. :) I’m always open to feedback at dougouk@gmail.com